Our Capabilities

Strategic Consulting

Implementation Services

Managed Services

Staff Augmentation Services

Implementation Services

Automated Testing

Asset owners are under growing pressure to cut costs and improve efficiency—yet increasingly complex IT ecosystems and rapid adoption of XaaS, APIs, and AI have turned regression testing into a major barrier to growth.

Most asset owners struggle with automation due to fragmented systems, non-web-based applications, and high-risk workflows that demand rigorous testing.

FINARCH’s approach removes these barriers with a practical framework built for scale:

Vendor Agnostic – Compatible with any OMS/EMS, IBOR, or ABOR system

Tool Agnostic – Leverages your existing toolkits with no added licensing costs

Configuration Light – Minimal setup, fast deployment, and immediate ROI

We help firms modernize testing with a tailored, low-maintenance solution—built for the unique demands of capital markets.

BPA vs RPA - What approach to take for Automated Testing?

After reflection from previous projects, combined with our experience working with Asset Owners, we believe the path forward to automated testing is through incremental business process automation (BPA).

RPA is best-used for web-based systems where there is a wide variety of existing RPA automation tools. Capital market systems are widely ‘legacy’, where extensive configuration and development is required to read/input into the applications.

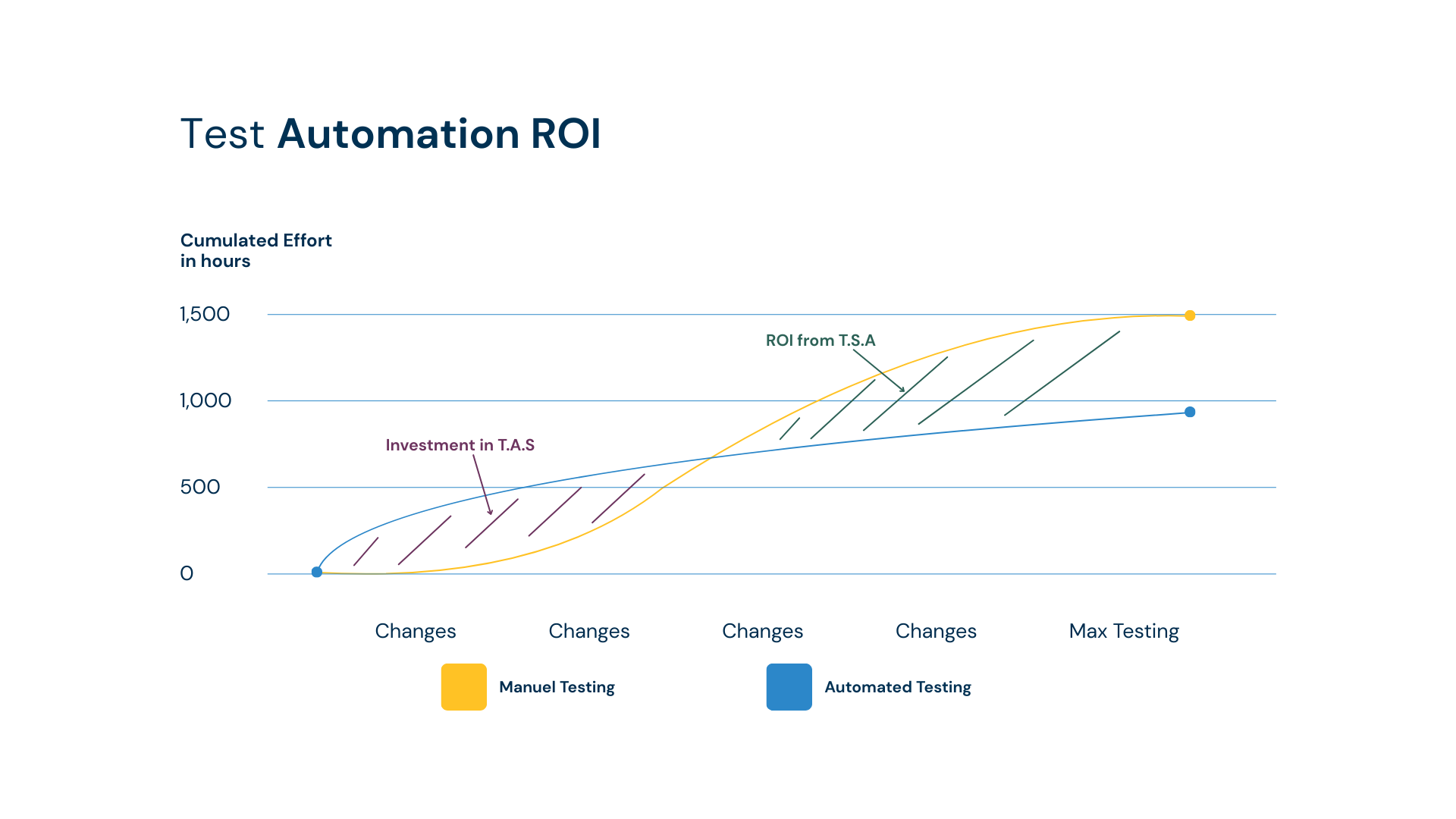

BPA aligns with our guiding principles of being tool/vendor agnostic, and configuration light to ensure the solution is easy to maintain and enhance. BPA is low cost, where implementation can be done incrementally and return on investment can start accruing almost immediately.

| Robotic Processing Automation (RPA) | Business Process Automation (BPA) |

|---|---|

| Extensive new configuration and development is required, often using specific applications which will require additional costs and onboarding time | Tool and vendor agnostic and can be built with existing IT ecosystem, without any additional licensing costs or application onboarding time |

| Large investment is required to stand up the initial implementation, including script development and new system configuration | Uses existing build and configuration which lowers maintenance and implementation cost, typically with a < 1 year payback period for cost savings |

| Not future proof. As ‘legacy’ systems continue to be more integrated with web-based UIs, creating RPA scripts may become redundant in the future | Easy to enhance and expand usage as it leverages existing integration components and system upgrades/BAU changes often have minimum or no impact to automation suite |

| Costly and difficult to maintain, when there are system upgrades which change the UI, which will cause refactoring and new development time | Quicker to implement, faster to execute, and easier to maintain. Can cover the core functionality that typically causes high priority/severity issues in Production |

Automated Testing Foundation

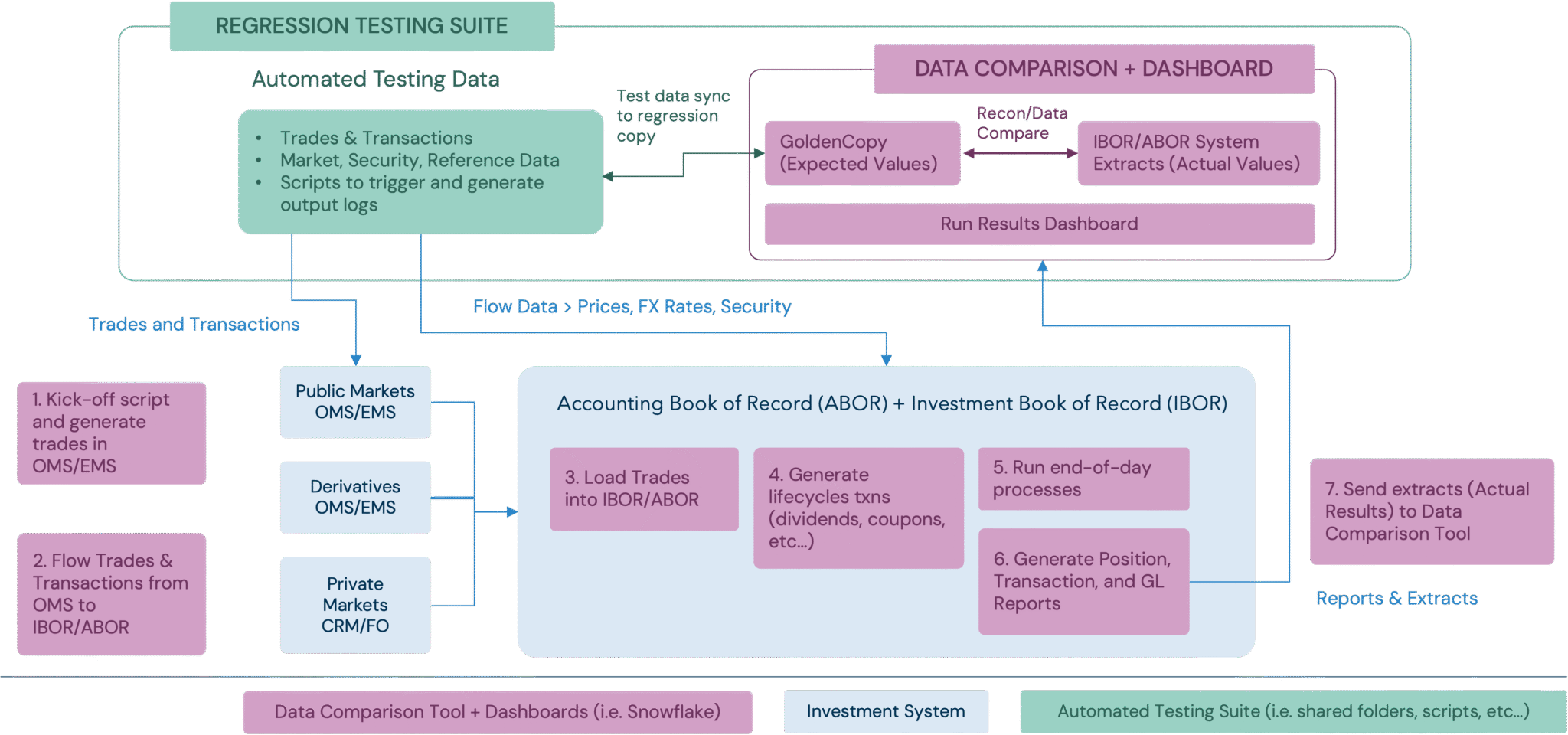

Our foundation build jumpstarts your automation journey with three core objectives:

- Establish a baseline suite of automated test cases, with a backlog for future expansion

- Set up processes, scripts, and technology for a one-click execution and results dashboard

- Equip internal teams with the skills and model needed for successful automation

Once the foundation is in place, test coverage and systems can be expanded incrementally.

Equity Workflow

The automated workflow for Equity testing includes:

Data Setup: Create sample market, reference, and static data for all relevant test scenarios

Trade Flow: Send Equity trades through OMS/EMS to generate tickets and flow into IBOR/ABOR

Lifecycle Processing: Trigger day-in-the-life events like dividends, NAV, and collateral activities

Results Comparison: Extract and compare actual vs. expected results to detect regressions

Dashboard Validation: Review outcomes through a centralized Run Results Dashboard

This end-to-end workflow ensures accuracy and consistency across systems.

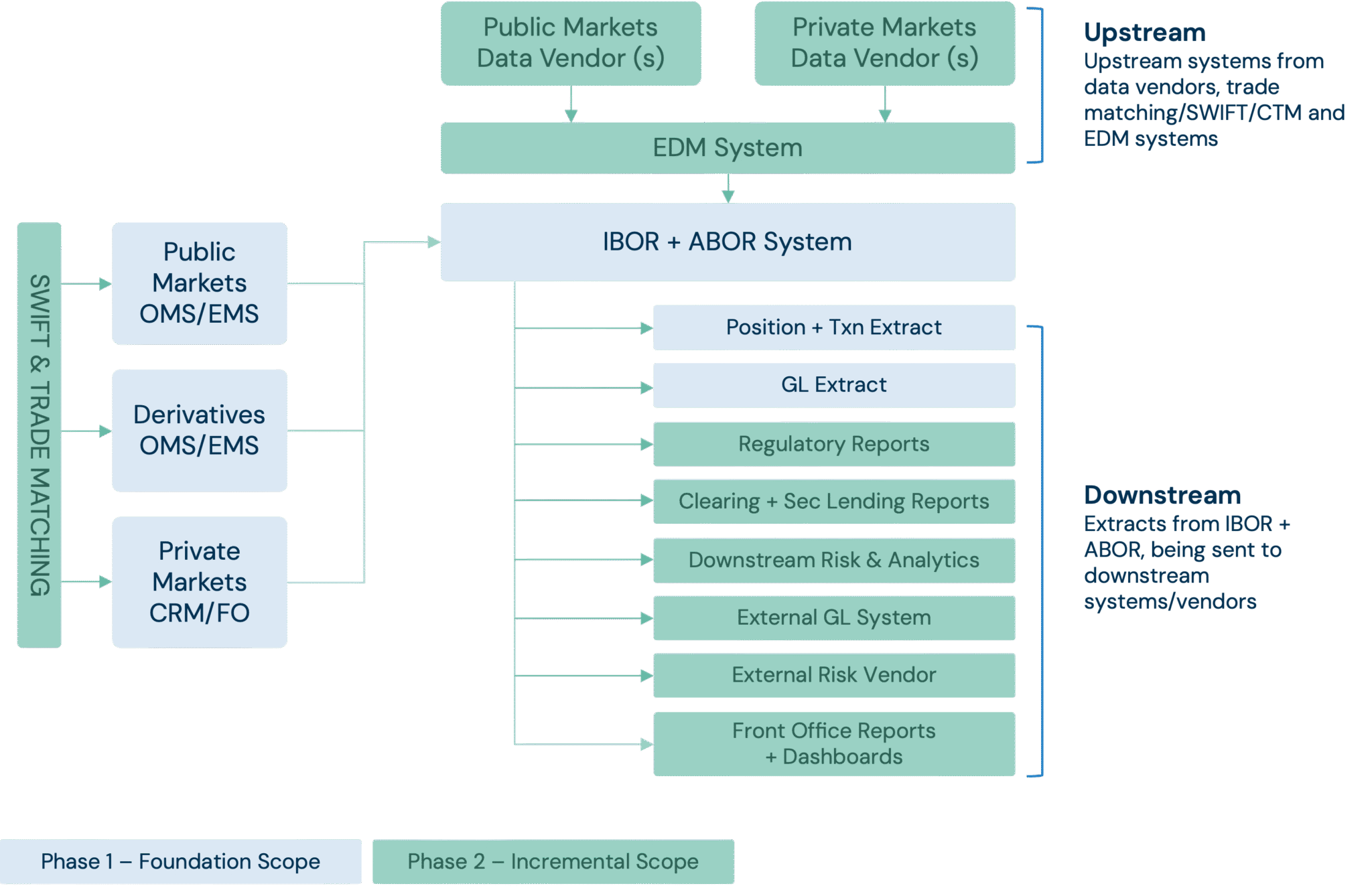

Expanding Usage of Automation Suite - Further Enhancement

After the foundation suite has been built (Phase 1), we can incrementally expand coverage to address other key regression areas.

From our experience, this includes

- Downstream reporting – especially related to regulatory or other critical reports, and reports being sent to other vendors/systems

- Upstream feeds from data vendors

(i.e. bbg, reuters, and privates data) - Trade lifecycle enhancements, such as SWIFT/CTM/Matching which is often difficult and not recommended for the initial foundation build

Enhancements can be prioritized based on business user needs and manual testing effort to improve operational efficiencies.

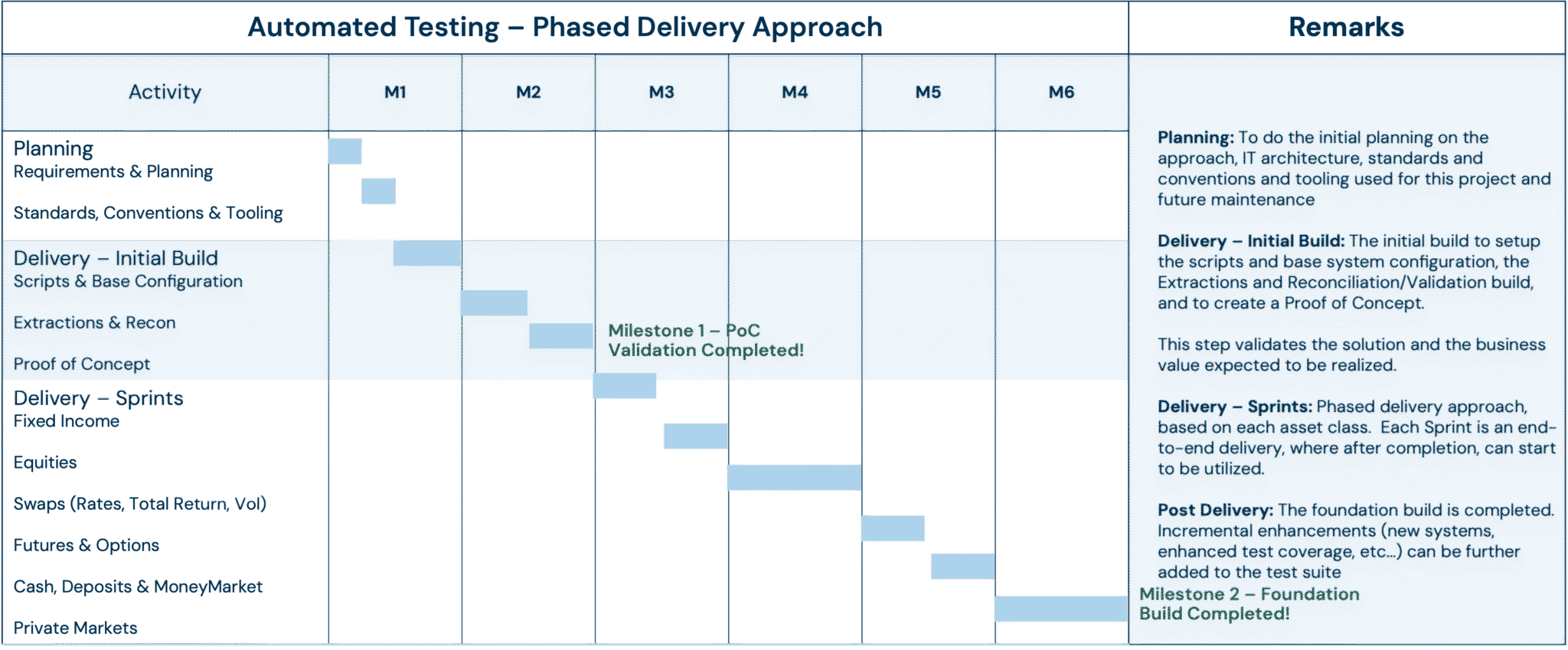

Example Timeline